- Testing Recent Applications: This involves testing applications you’ve quoted outside of AI Insurance. We use this data to compare similar scenarios directly.

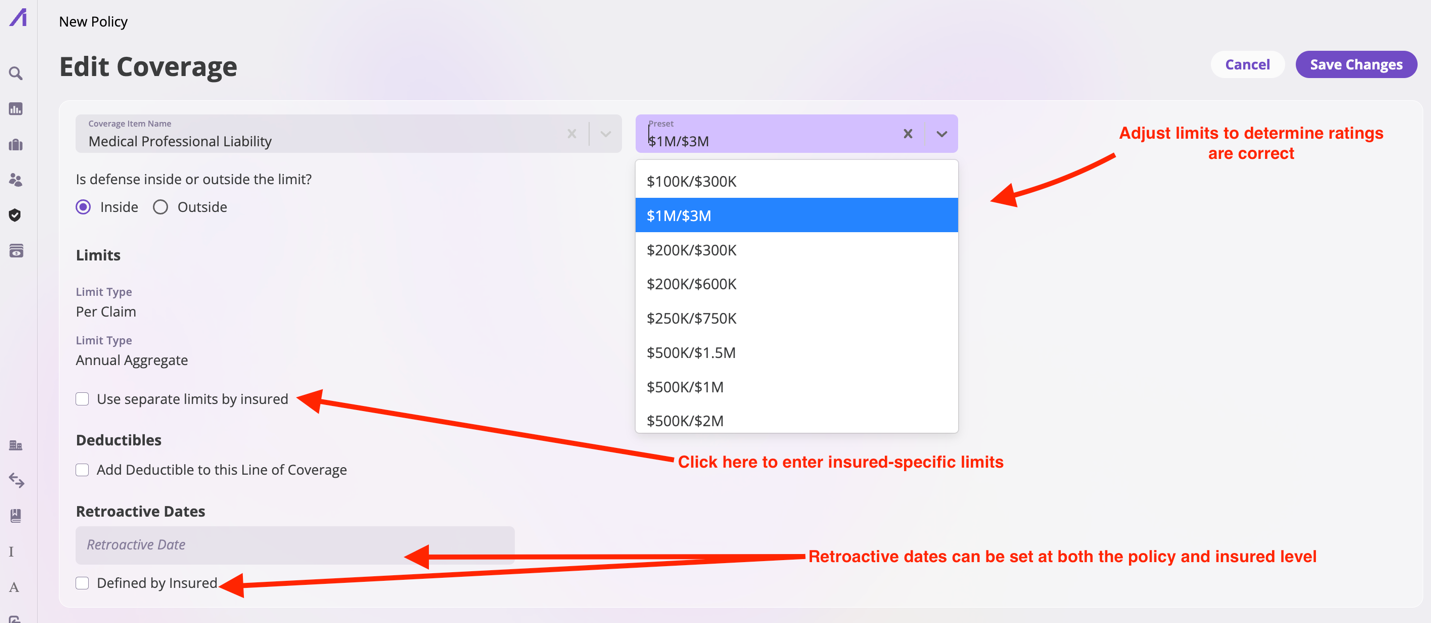

- Testing Edge Cases: We don’t just test the basics; we also check how well AI Insurance handles unusual situations. For example, we look at scenarios like part-time applicants, retroactive dates, and customized coverage options to ensure our system can handle them effectively.

- Testing User Experience: We evaluate how the system feels and flows for users. For instance, we examine how rating questions are presented at the insured and policy levels to ensure a smooth and intuitive experience.

How to rate in the AI Insurance platform

Insureds and Policies live separately in AI Insurance. As such, some Rating questions are located on the insureds and, separately, on their corresponding policies. In the steps below, we’ll create Insureds and Policies and test the Rating Engine.Creating an Insured:

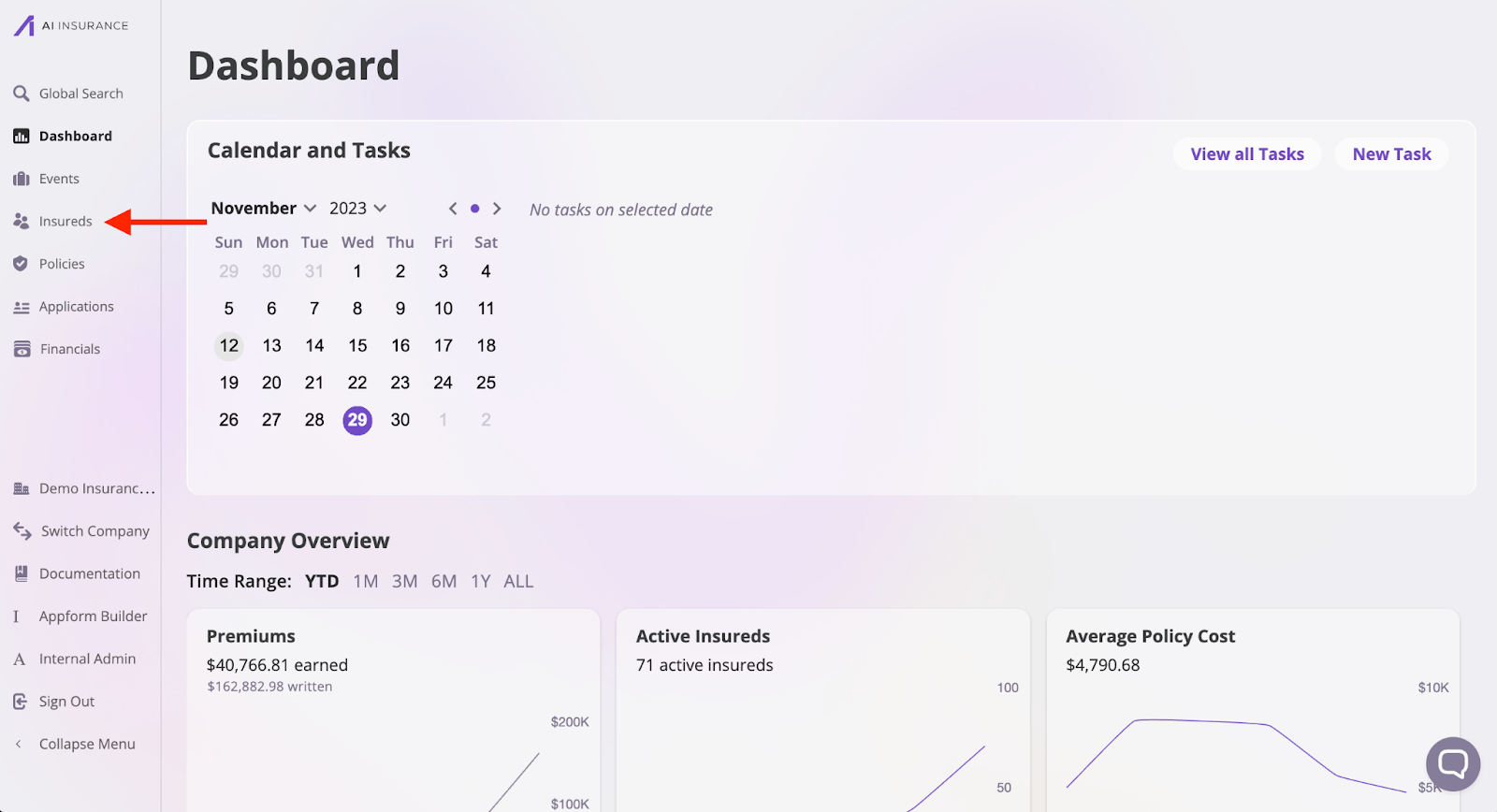

Follow these steps to ensure that all the necessary questions are being asked to properly rate an Insured- Click on Insureds

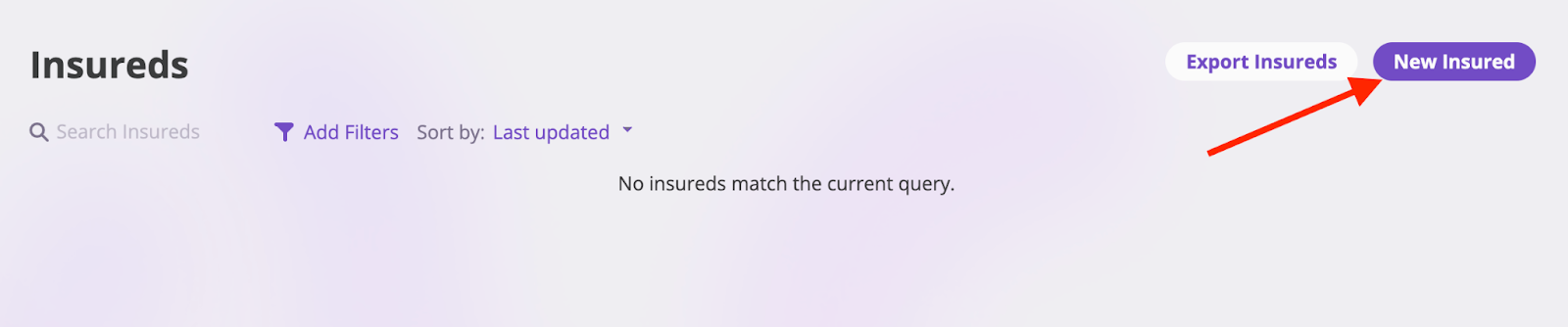

- Click on New Insured

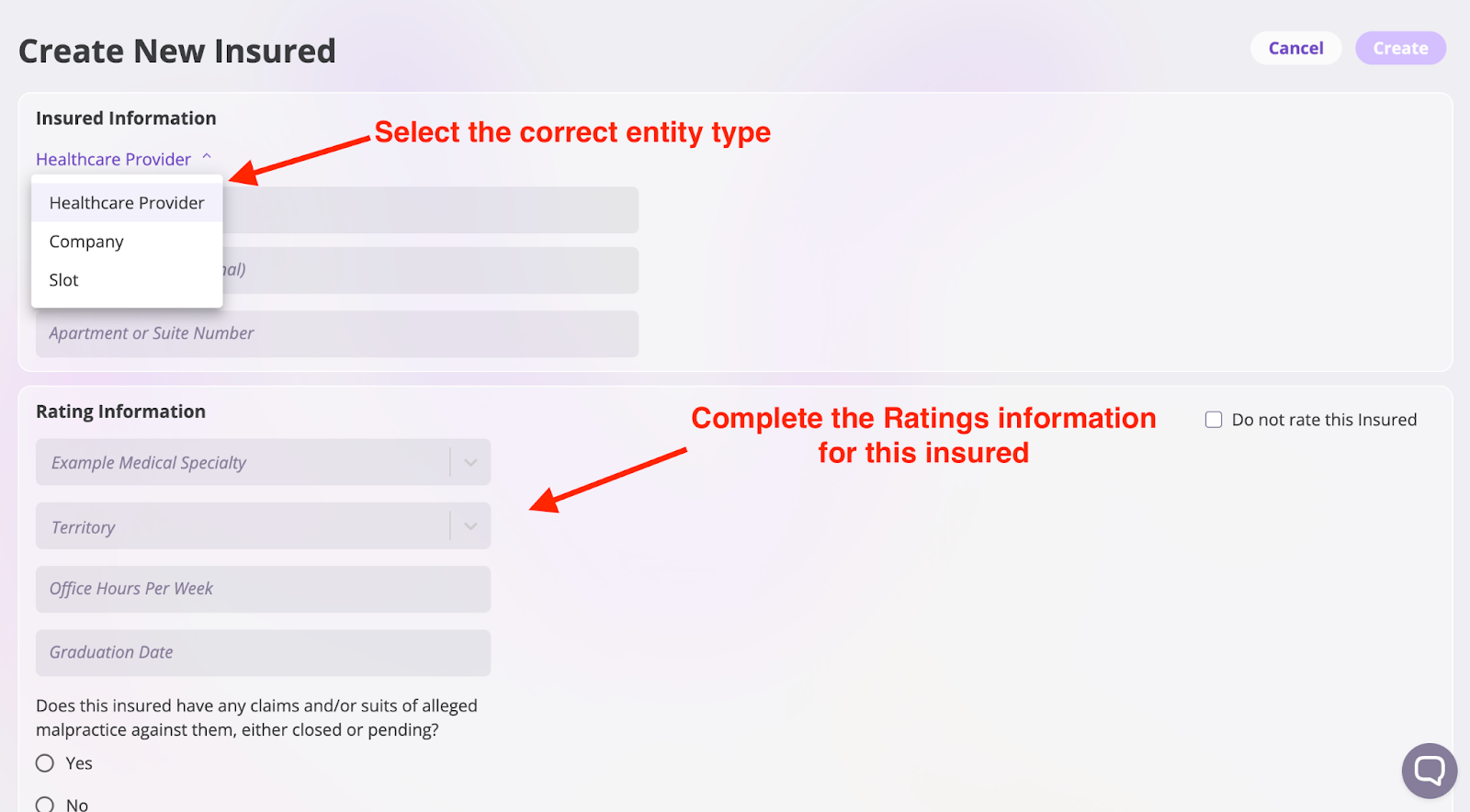

- Select the appropriate entity type with a rating question (e.g. a Healthcare Provider’s specialty) and enter information for the insured. Click Create when finished.

Creating Policies:

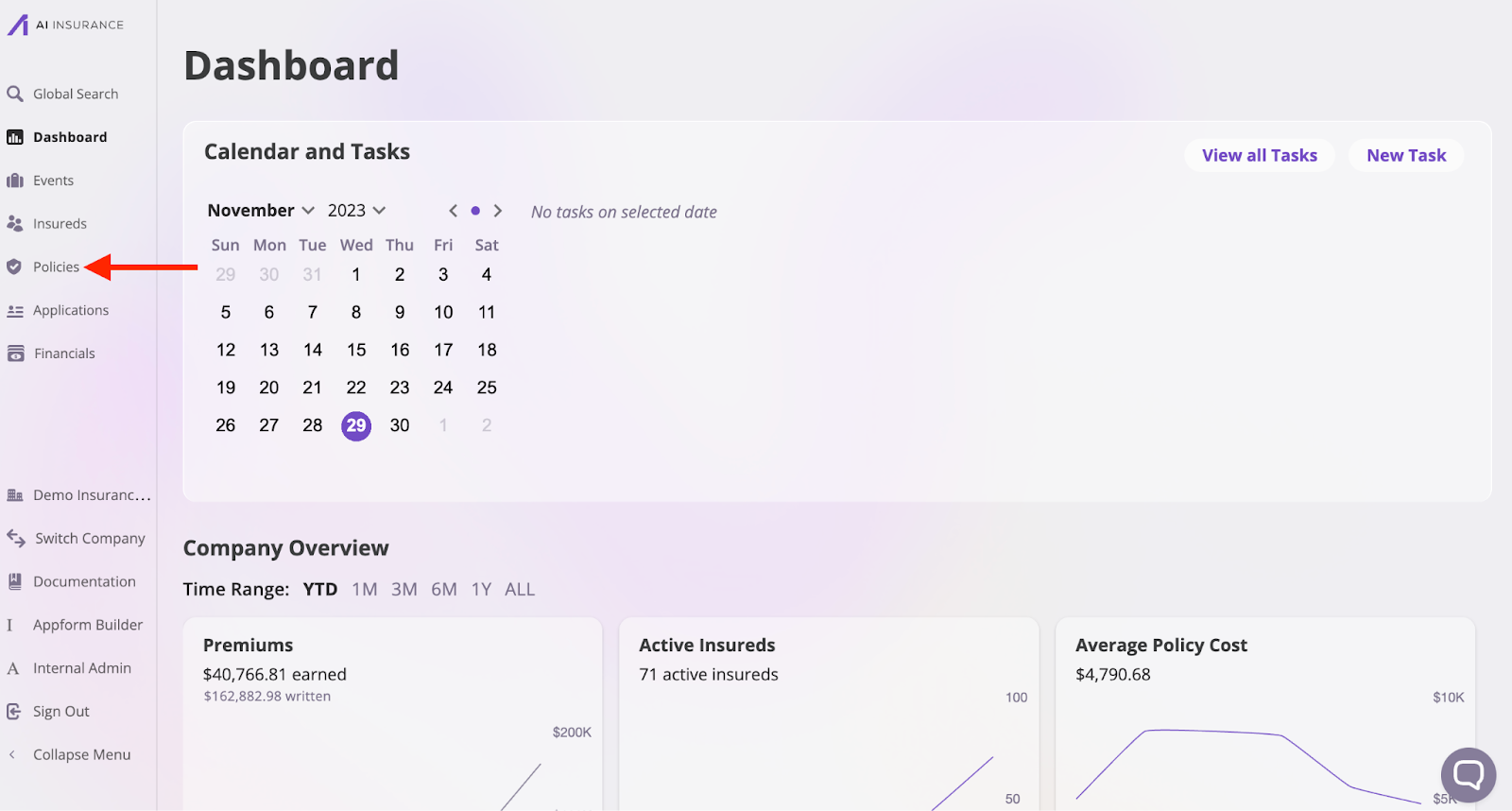

Follow these steps to ensure that all the necessary questions are being asked to properly rate an Insured.- Click on Policies

- Click on New Policy

-

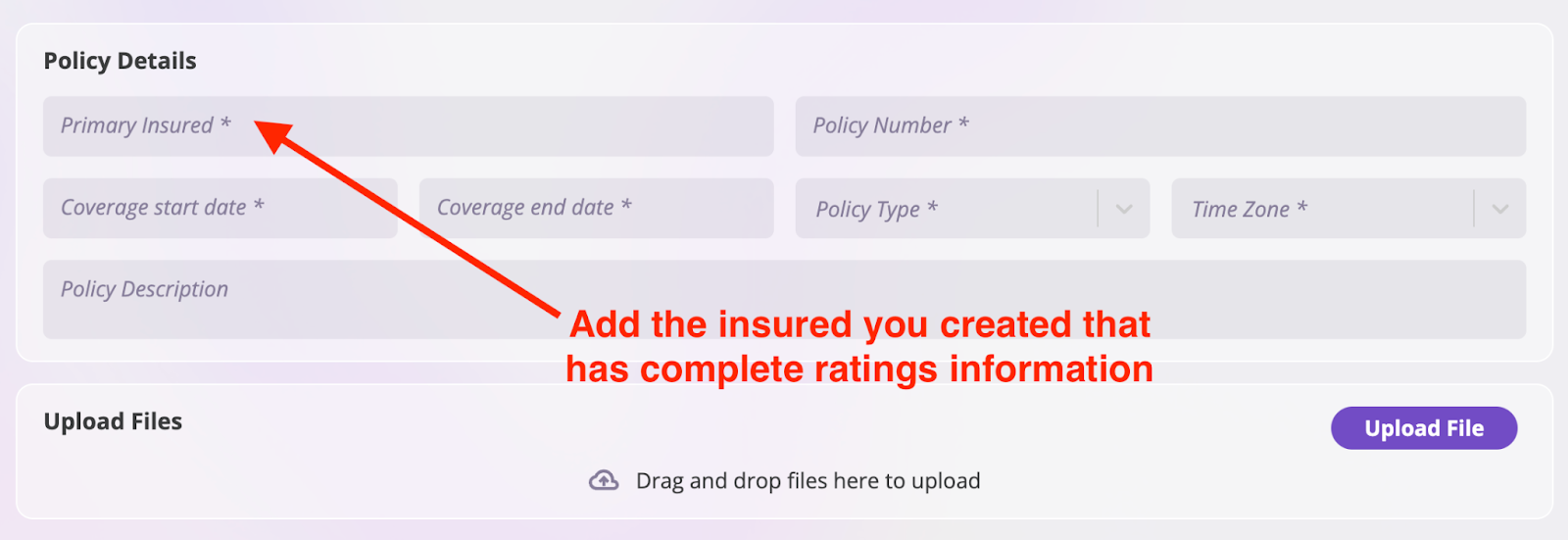

Enter the following:

- Primary Insured/Policyholder (Choose the Insured created above)

- Policy Number Note: This can be changed before the policy is bound, so you can use whatever you like for testing and/or quoting purposes

- Coverage Start/End Dates

- Policy Type

- Time Zone

- Add insureds to policy (This may or may not be relevant based upon your use case)

- Named

- Additional

- Related Entity

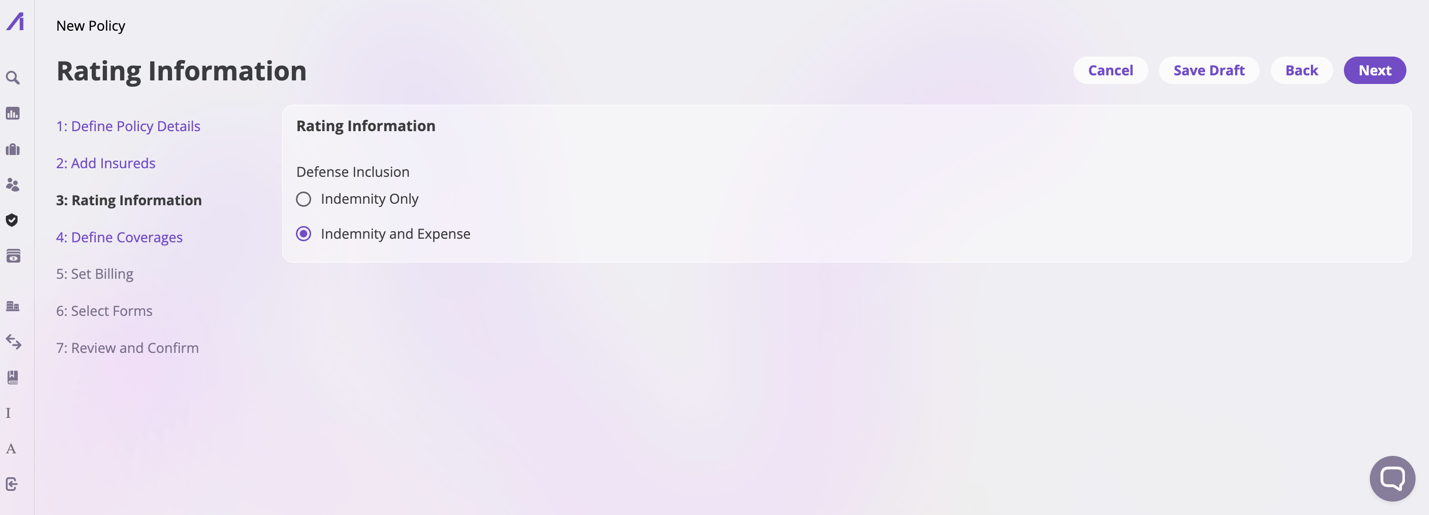

- Enter the policy-specific Rating engine answer

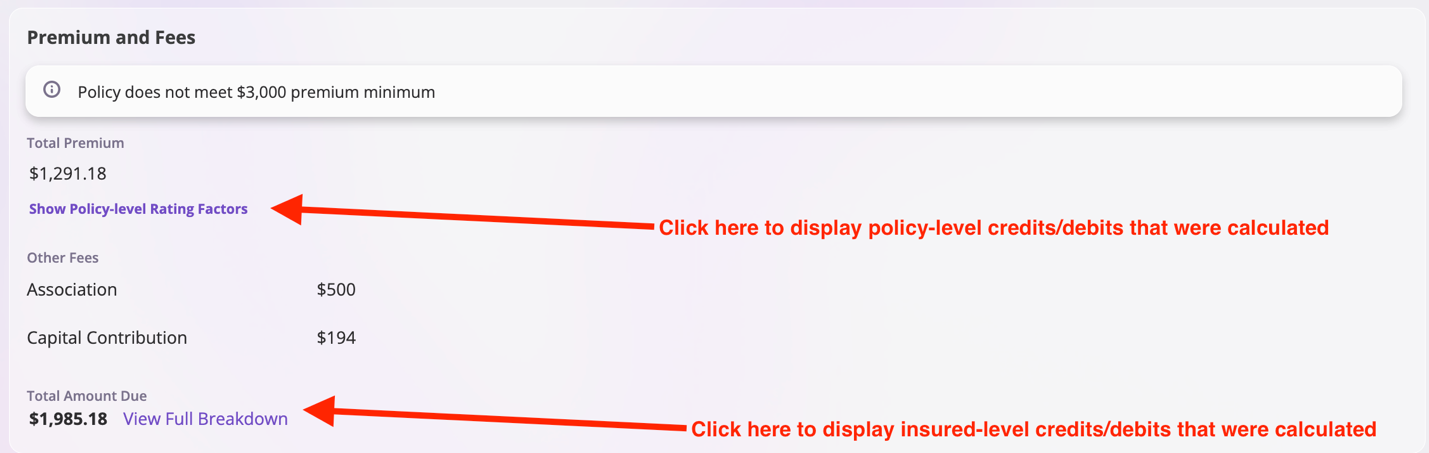

- Evaluate the Rating calculations + default lines of coverage

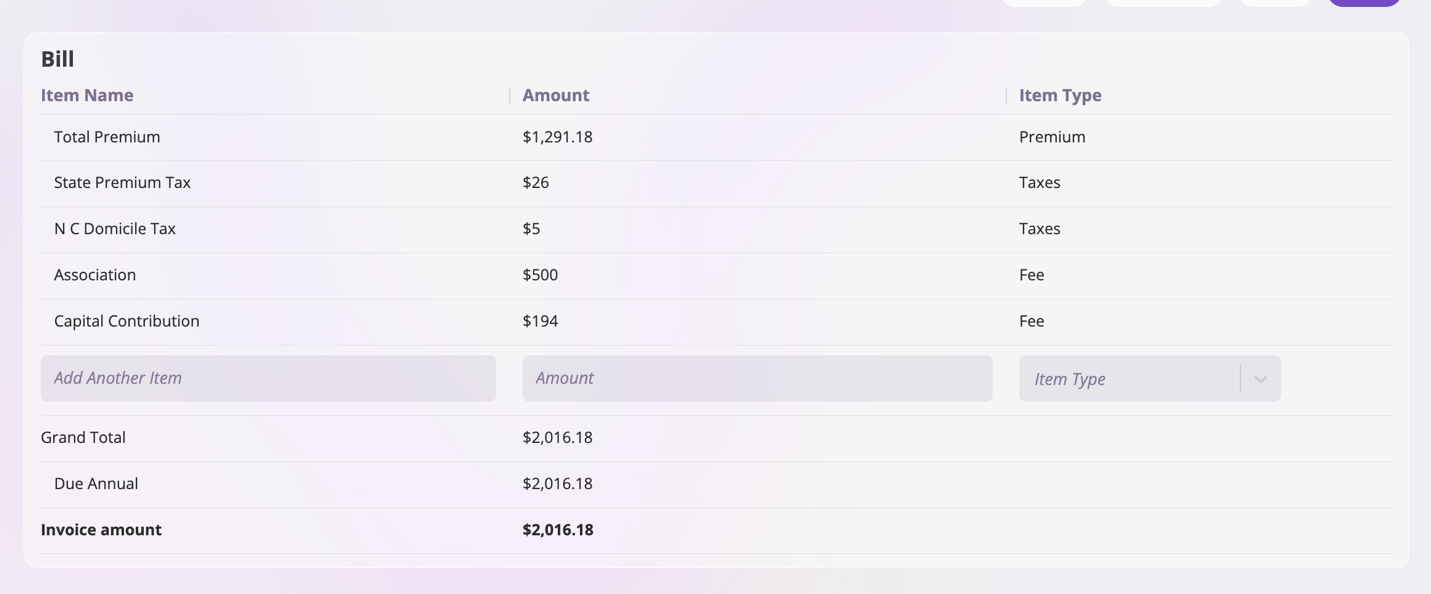

- Premium and Fees

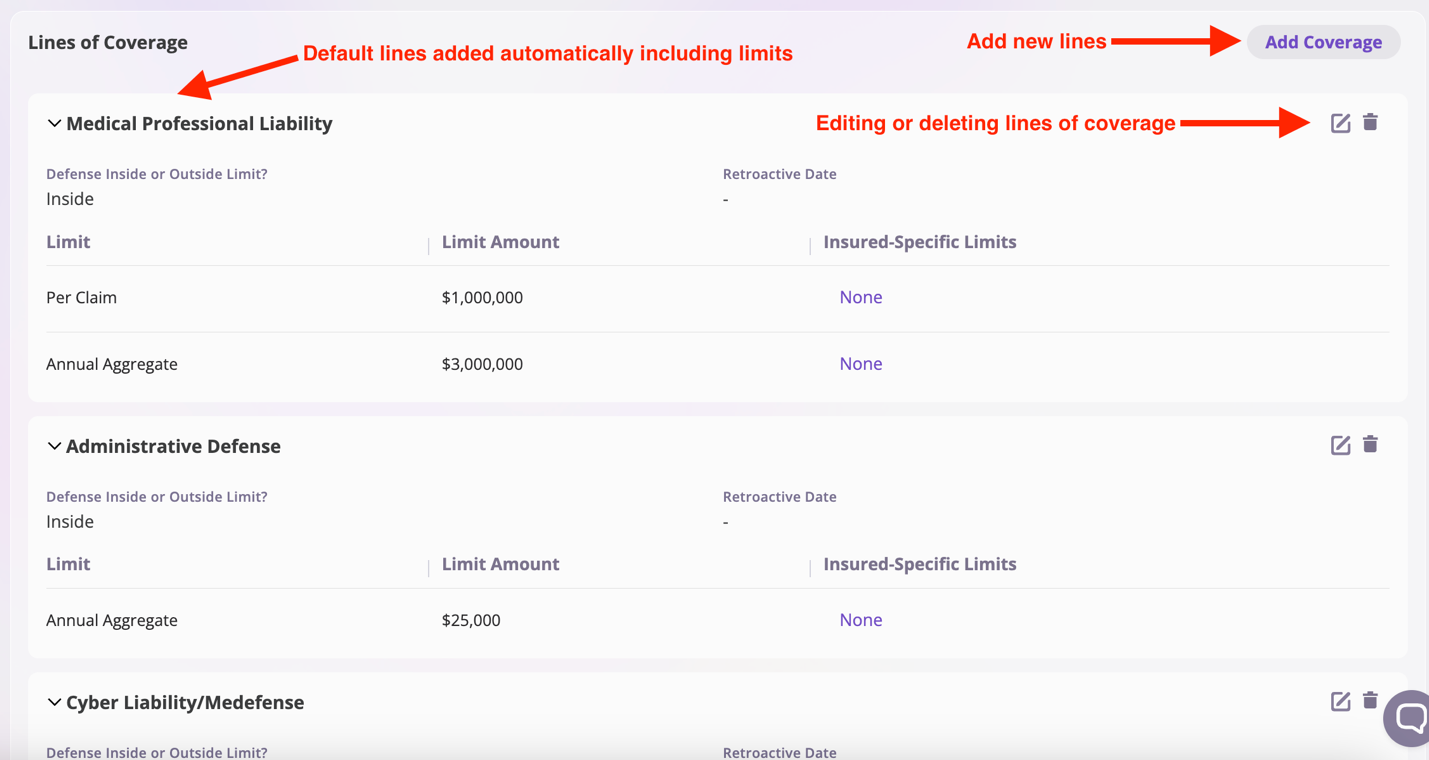

- Lines of coverage

- Editing Lines of Coverage

- Determine if all fees have been added and calculated correctly in the next step

Compare to the Rating Engine configuration document

Now that a policy has been generated that includes Rating compare the results to your Rating Engine Configuration Document. The goal is not to match whatever your old or internal rater says, but rather the documented requirements are. This will verify whether or not the numbers are matching. If it does not match, here are some debugging recommendations on where to investigate:- Are all credits and debits accounted for? Check the section in your Rating Engine Configuration document listing all credits and debits. Make sure nothing is missing and that the calculations are accurate.

- Is there a difference in rounding? If the results are within +/- 1%, it could be due to rounding variations between the two raters. Ensure rounding rules are documented in your Rating Engine Configuration document for confirmation. Please consult to confirm.

-

Comparing Apples to Apples is extremely important. Confirm the following:

- Your configuration document is correct.

- All insureds have been added to the policy.

- The correct policy start and end dates have been selected.

- The appropriate policy type was chosen (e.g., Claims Made vs Occurrence).

- All lines of coverage are included.

- The limits for each line of coverage are correct.

- Policy-level limits are correctly set.

- Retroactive dates have been properly set for all insureds or at the line of coverage.

- All Rating-oriented questions at the policy and insured level are accurately answered.